LED display cost has always been the make-or-break factor for how quickly new innovations catch on. Right now, the small-pitch LED market is witnessing a pivotal shift: the once-significant price gap between MIP and COB LED display.

It is narrowing faster than anyone predicted. Industry insiders are betting on a “price crossover point” as early as 2026, a development that won’t just change how businesses choose display tech, but will reshape the entire supply chain’s competitive landscape. Let’s guide you these details.

Table of Contents

ToggleFrom Night and Day to Neck and Neck

LED display innovation has always balanced two goals: better performance and manageable costs. When flip-chip COB technology emerged in 2017, shrinking LED chips became the industry’s north star. But the arrival of MIP technology shifted the game from a “one-winner-takes-all” race to a multi-tech ecosystem.

To understand the cost shift, you first need to grasp how these technologies differ.

COB LED Technology:

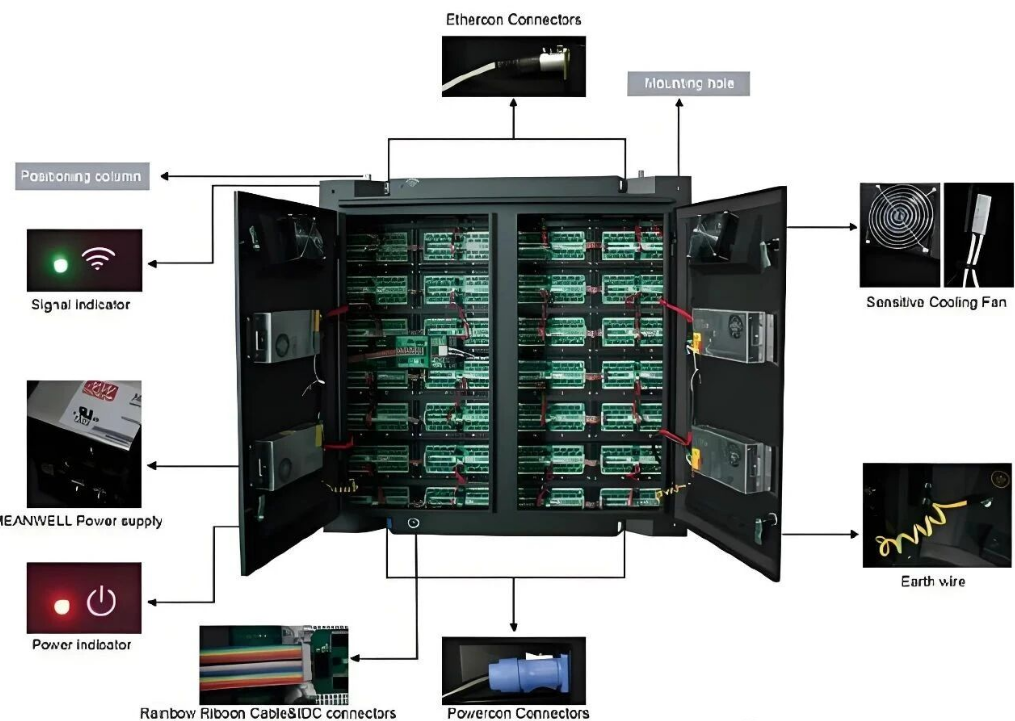

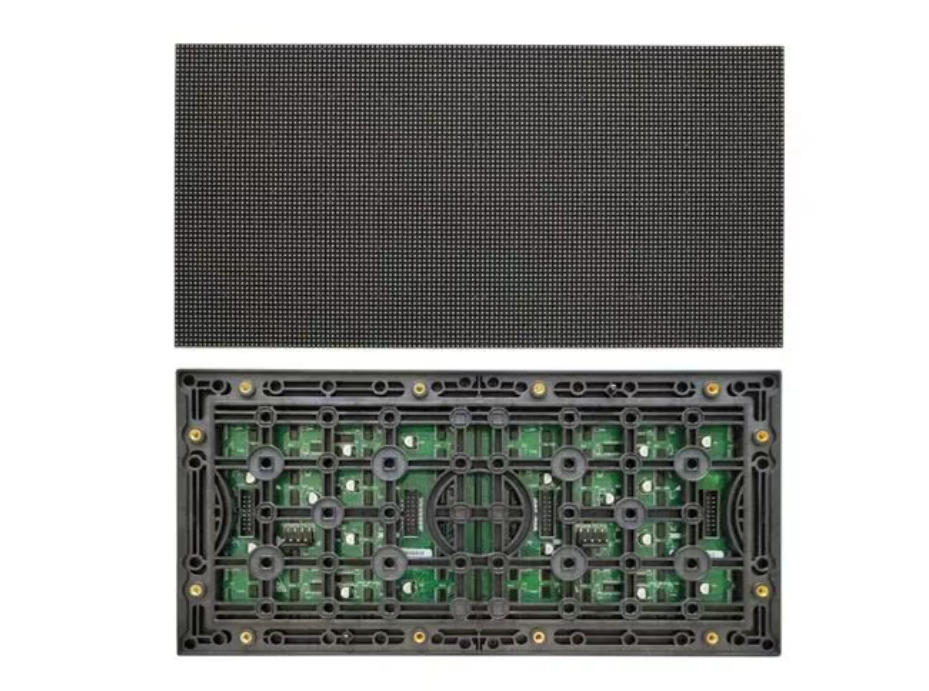

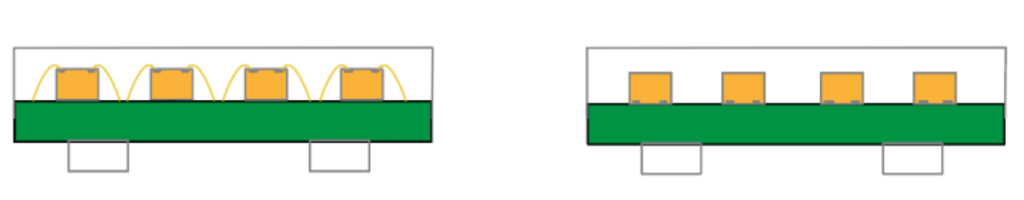

COB mounts LED chips directly onto a PCB and encapsulates them as a whole. Its high integration and strong heat dissipation helped it quickly dominate the small-pitch market.

But as demand for ultra-fine pixel pitches grew, COB hit limits: reliability issues and inconsistent optical performance held it back from high-end applications, like medical imaging or XR virtual production .

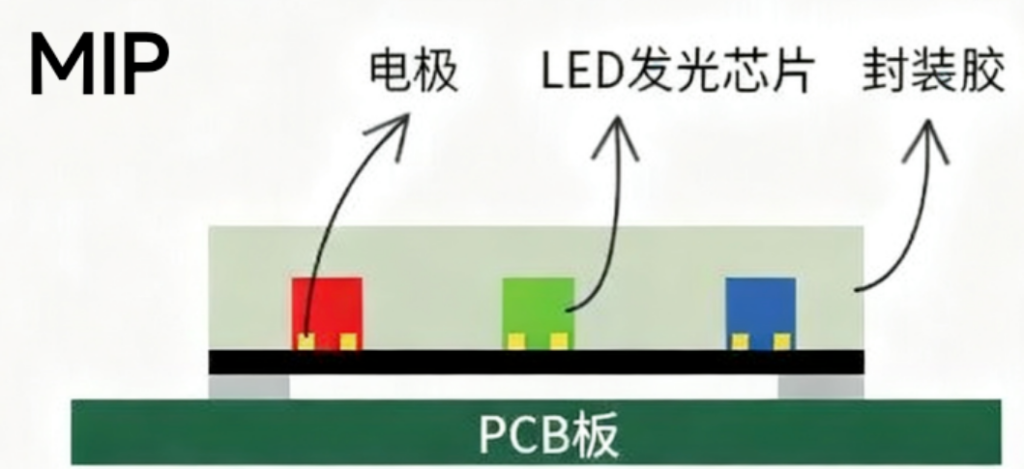

MIP LED Technology:

MIP takes a more precise approach. It uses mass transfer technology to place micro-scale chips onto a substrate, then uses a transparent conductive film for circuit connections. In other words, it ditchs traditional LED brackets entirely. So, MIP LED has thinner, more reliable displays with consistent brightness. They have more better performance in long-term stability. Unsurprisingly, MIP commanded a premium in high-end markets early on .

Today, the price gap is still noticeable but shrinking fast. MIP has fallen from its late-2024 high to around $1~$1.2 per thousand chips, while COB hovers between $0.6 per thousand chips. It is nearly half the cost. But dig deeper, and you’ll find most LED display manufacturers’ actual production costs are just over $0.1 per thousand chips. That means both technologies have plenty of room to adjust prices as competition heats up .

The trend tells the real story. COB has undergone multiple price cuts over the past two years to grab market share, expanding its reach. However, MIP has broken through mass production bottlenecks: as capacity ramps up, its cost advantage grows. Their price curves are now accelerating toward each other .

Why Costs Are Converging: Capacity, Process, and Supply Chain Synergy

The narrowing gap isn’t an accident. it’s the result of three powerful forces working in tandem:

- Scaled production,

- Process optimization

- Supply chain collaboration.

Scaled production

For MIP, scaling up production is the biggest cost driver. Until recently, mass transfer technology limited output, keeping unit costs high.

But over the past two years, mass transfer equipment has matured, and production processes have streamlined. Leading LED display manufacturers are moving from small-batch trials to large-scale production, spreading out fixed costs like equipment depreciation and R&D expenses.

Companies like SightLED’s partner have improved transfer speeds to 10 million chips per hour and raised yields to 99.995%. It significantly cuts waste and slashing costs .

COB is holding its own through process improvements. China mass transfer equipment has become more affordable, reducing upfront investment. Better chip repair technology has also boosted yields, minimizing material waste from damaged chips. These tweaks have helped COB stay competitive even as MIP closes in .

Process optimization

The supply chain is pulling its weight too. Packaging accounts for over 30% of LED component costs, so both technologies are innovating with materials. MIP optimizes the thickness and material of transparent conductive films to reduce consumption. COB uses new encapsulation resins that cut costs without sacrificing protection.

Supply chain collaboration.

Equipment makers are also launching dual-compatible production lines, letting manufacturers switch between MIP and COB without major retooling. They make the entire supply chain more efficient .

Market pressure is the final push. With end-users more price-sensitive than ever, both technologies need to cut costs to expand. This “volume-for-price” trend is forcing manufacturers to balance performance and affordability, speeding up cost-reduction efforts across the board .

From Tech Rivalry to Scene-Specific Segmentation

As costs converge, MIP and COB are no longer direct competitors. They’re evolving into complementary technologies, each dominating specific use cases.

COB’s first-mover advantage and cost base make it king of mid-range commercial markets. After nearly a decade of development, it’s technically mature with a stable supply chain. It’s the top choice for conference rooms, command centers, and digital signage. These scenarios need display precision.

COB is also expanding. They are pushing into ultra-fine pitches to target high-end markets, while covering larger-pitch commercial uses to grow its scale .

MIP is carving out space in high-end applications thanks to its performance edge. Medical imaging, XR virtual production, and premium commercial displays demand uncompromising reliability and optical consistency. Even with its higher price, MIP is becoming the go-to for these sectors .

For Emerging markets like education and automotive, the two technologies clash. Education buyers prioritize cost, so COB leads here. But automotive displays need rock-solid stability. So, MIP’s wire-free, fully sealed design solves traditional “caterpillar” line defects, winning over carmakers .

Tech fusion is the new frontier. Some companies are testing hybrid packaging: using MIP and COB in different areas of ultra-large displays to balance pixel density and cost.

Others are combining MIP with quantum dots to boost color performance, closing the gap with COB. The winners won’t be the companies that bet on a single technology, but those that match the right tech to the right scene .

Will 2026 Bring the Price Crossover? Possibilities and Challenges

Industry insiders increasingly agree: the MIP-COB price crossover could happen after Q1 2026. Three factors support this prediction: cost trajectories, capacity cycles, and shifting demand.

On costs, MIP still has room to fall. As production scales further, economies of scale will push its unit costs toward COB’s actual production costs. However, COB has limited room for deep cuts. Because too much price decline would squeeze R&D budgets and slow innovation. Its price decline will likely slow down .

Capacity timing is key. MIP production is ramping up fast: new lines will come online by late 2025 to early 2026, driving prices down.

COB capacity is already saturated, with fierce competition keeping prices under pressure. This “one rising, one stable” capacity dynamic will speed up the crossover .

Demand for better performance is the final piece. For Emerging applications like 8K ultra-HD and transparent displays, it requires higher performance. Even with its higher price, MIP’s value shines in these areas. Once the price gap narrows enough, performance will become the key selection factor. So, it is pushing MIP to replace COB in some segments .

But challenges remain. COB still leads in ultra-fine pitches, and its panel-based packaging offers hard-to-beat cost advantages for ultra-large displays.

MIP can’t fully penetrate professional markets without breaking through ultra-fine pitch technical bottlenecks. Variables like driver IC integration and mass transfer yield improvements could also delay the crossover .

The Bottom Line:

From Mini COB to Micro MIP, LED display innovation follows a simple rule: better performance at lower costs. The narrowing price gap between MIP and COB is part of this democratization, while mature tech stays competitive through process tweaks. Ultimately, this benefits everyone: manufacturers, distributors, and end-users.

The future of LED displays won’t be about one technology dominating. It will be about matching the right tech to the right scene. For businesses, this means more choices that balance performance and budget. For consumers, it means better displays in more places.

We believe the 2026 price crossover isn’t just a milestone for MIP and COB. It’s the start of a new era in LED displays.

As the gap closes, the real winner won’t be MIP or COB. It will be anyone who wants high-quality, reliable LED displays. As a professional LED display supplier, we offer a variety of small-pitch LED screens. Please feel free to contact us if you have any needs.